lincoln ne sales tax 2020

There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825. The Lincoln sales tax rate is 175.

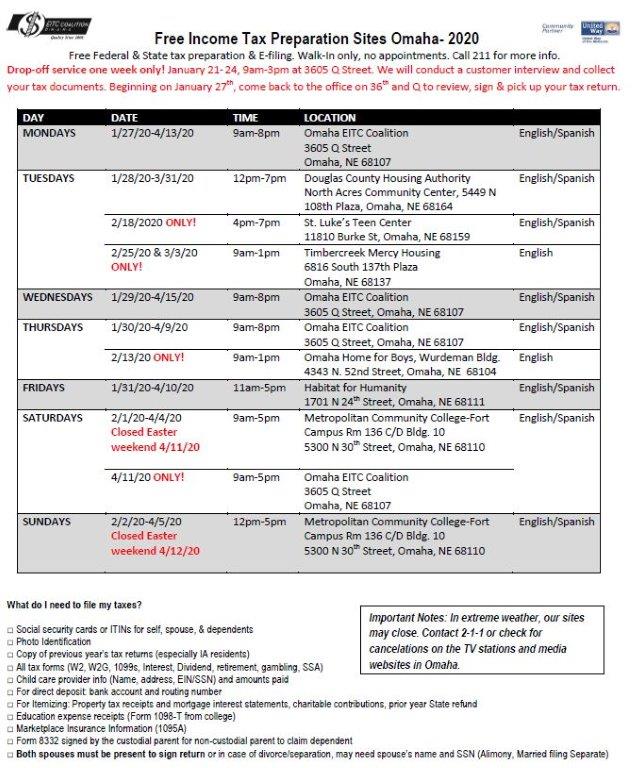

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

The Lincoln County sales tax rate is.

. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Select the Nebraska city from the list of popular cities below to. Average Sales Tax With Local.

Real Estate and Personal Property Department. Has impacted many state nexus laws and sales tax collection requirements. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

The December 2020 total local sales tax rate was also 7000. The Nebraska sales tax rate is currently 55. 308 534-4350 ext 4154.

The Nebraska state sales and use tax rate is 55 055. The minimum combined 2022 sales tax rate for Lincoln County Nebraska is. North Platte NE 69101.

For more information on sales tax visit the Nebraska website. For tax rates in other cities see Nebraska sales taxes by city and county. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The County sales tax rate is 0. Nebraska has recent rate changes Thu Jul 01 2021.

301 North Jeffers Room 102. Did South Dakota v. The Nebraska state sales tax rate is currently.

31 rows The state sales tax rate in Nebraska is 5500. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

There are no changes to local sales and use tax rates that are effective July 1 2022. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. This is the total of state county and city sales tax rates.

308 534-4350 ext 4142. 5308 Wilshire Blvd Lincoln NE 68504 179900 MLS 22210540 This 3 plus 1 bedroom 2 bathroom 2000 sq ft 1 12 story home has been freshened up. With local taxes the total sales tax rate is between 5500 and 8000.

October 1 2015 City of Lincoln sales and use tax rate increased from 15 to 175 1 the city of fruit. 025 lower than the maximum sales tax in NE. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. You can print a 725 sales tax table here. To review the rules in New Mexico visit our state-by-state guide.

Has impacted many state nexus laws and sales tax collection requirements. 3 beds 2 baths 2020 sq. There are no changes to local sales and use tax rates that are effective January 1 2022.

The 2018 United States Supreme Court decision in South Dakota v. Back in February two major streets in Lincoln were riddled with potholes before getting re-paved with money from the quarter-cent sales tax. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or.

This is the total of state and county sales tax rates. Introduces 15 sales and internal use tax. There will be a Joint PoliceFire Headquarters on January 16 2019 AFP Lincoln harmful sales.

On Friday the area near S 40th and Highway 2 was just. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. There is no applicable county tax or special tax. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

What is the sales tax rate in Lincoln Nebraska. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725.

Groceries are exempt from the Nebraska sales tax. You can print a 725. 308 534-4350 ext 4151.

Lincoln 175 725 0725 2-285 28000 Linwood 10 65 065 201-287 28245 Loomis 10 65 065 149-291 29085 Louisville 15 70 07 107-293 29260 Loup City 20 75 075 90-294 29470 Lyons 15 70 07 108-298 29855 Madison 15 70 07 113-299 30240 City Local Total Rate Local FIPS. Nebraska Department of Revenue. Sales and Use Tax Rates Effective October 1 2020.

Lincoln 175 725 0725 2-285 28000 Linwood 10 65 065 201-287 28245 Loomis 10 65 065 149-291 29085 Louisville 15 70 07 107-293 29260 Loup City 20 75 075 90-294 29470 Lyons 15 70 07 108-298 29855 City Local Total Rate Local FIPS City Local Total Rate Local FIPS 1. The New Mexico state sales tax rate is currently. Sheri Newton- Deputy Treasurer.

The Lincoln County sales tax rate is. Includes the 050 transit county sales and use tax. 800-742-7474 NE and IA.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau

Pre Owned Subaru Used Vehicles For Sale In Lincoln Ne Near Milford Crete

Contact Us Nebraska Department Of Revenue

Lotm Frequently Asked Questions City Of Lincoln Ne

2020 Nebraska Property Tax Issues Agricultural Economics

Nebraska 155th State Admission Anniversary 1867 March 1 2022

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Nebraska Ended Fiscal Year With More Revenue Than Expected

/cloudfront-us-east-1.images.arcpublishing.com/gray/QLZL7DPVTJBOHFAHCROPAKQY5E.jpg)

Lpd Sees Continued Rise In Catalytic Converter Thefts Despite New Requirements

Vehicle And Boat Registration Renewal Nebraska Dmv

Contact Us Nebraska Department Of Revenue

New Ford Explorer For Sale In Lincoln Ne Anderson Ford Lincoln

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)